Why the Digital Deposit Return Scheme Is / Is Not the Future of Recycling

Digital Deposit-Return Schemes: Adoption, Industry Concerns, and Challenges

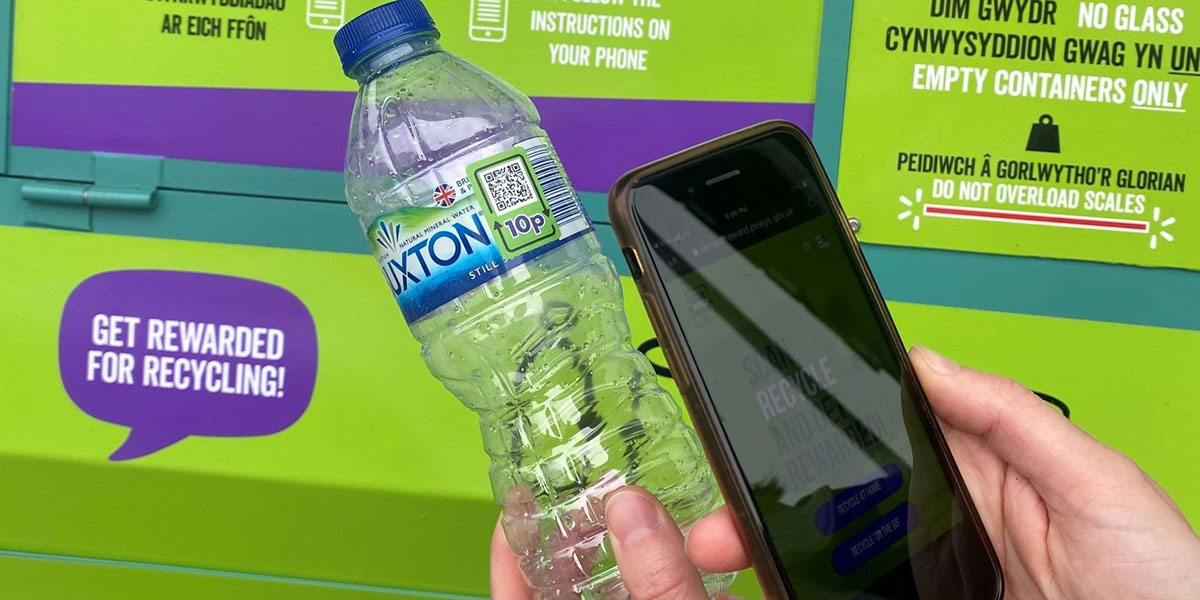

Digital Deposit-Return Schemes (DDRS) represent an emerging innovation in beverage container recycling. Unlike traditional deposit-return schemes where consumers physically return containers to designated points (reverse-vending machines or retail drop-off), DDRS allow redemption via digital codes, apps, or online platforms, potentially enabling returns through kerbside collection, postal systems, or hybrid approaches. This article examines current adoption, the objections and concerns of the industry, and underlying reasons for caution.

Innovation Promises of DDRS

Proponents of DDRS highlight several advantages:

- Broader container and format coverage supports a wider variety of packaging shapes, materials, and multipacks.

- Lower infrastructure capital: reduces need for expensive reverse-vending machines.

- Improved convenience for consumers: digital redemption via apps, enabling returns via kerbside or postal routes.

Current adoption landscape

While traditional DRS are established in many jurisdictions (over 50 operational systems globally according to the Reloop Platform), DDRS remain at a nascent stage. No full-scale national DDRS exists yet. DDRS promise flexibility, lower infrastructure costs, and improved consumer convenience, but wide-scale adoption is still limited.

Known DDRS trials

The following table summarizes known digital DRS trials globally:

| Location | Year | Key Details / Metrics | Source |

| Brecon, Wales, UK | 2023 | 18,794 rewards claimed; 58% returns via kerbside; compliance ~97.6% | WRAP Report |

| London (Enfield), UK | 2024 | Extended Brecon trial to city convenience stores | Better Retailing |

| Various small-scale pilots globally | – | No national-scale DDRS; pilot projects only | Reloop Platform |

DDRS trial in Belgium

Belgium is preparing to implement a national deposit return scheme for single-use plastic bottles and cans by 2025. However, approaches differ between regions—particularly regarding the digital versus traditional model. Flanders favours a digital model while Wallonia and Brussels lean toward more traditional approaches. The most recent report on DDRS pilot results were published in December 2023 (led by Fost Plus and partners).

The report indicates generally positive user reactions (Fost Plus cited >60% positive ranking from participants). The report however stresses need for wider data and emphasises that scaling, inclusion, and behavioural change remain key uncertainties. Reportable numbers on outcomes (volumes collected, litter reduction) are still limited and subject to further data.

Industry Objections and Concerns

Despite the potential benefits, industry stakeholders have voiced strong reservations:

1. Feasibility of packaging & logistics

Adding unique codes at production line speeds is challenging; multipacks complicate deposit redemption.

2. Quality of returned material & environmental claims

DDRS may result in mixed or contaminated material streams; unclear if environmental gains are achieved.

3. Risk of fraud, system complexity, and consumer confusion

Digital access may exclude some users; scanning codes without physical return is a concern.

4. Unproven at scale & regulatory risk

Pilots have not yet demonstrated full-scale feasibility; industry fears fragmented rules

Underlying Reasons for Industry Hesitation

Deeper reasons for caution include:

- Feedstock value and contamination concerns

Traditional DRS ensures cleaner material; DDRS may reduce material quality.

- Unclear business/funding model and regulatory complexity

Responsibility for infrastructure, unredeemed deposits, and material ownership is uncertain. - Capital intensity & packaging redesign risk

Adding codes, modifying production lines, and managing digital logistics is costly. - Consumer behaviour and logistics challenge

Digital models may be less convenient or accessible for some consumers. - Timing and risk of making the ‘wrong bet’

Investing in unproven DDRS technology before traditional DRS is fully operational is risky.

Industry Trade-Body Position Statements

- Alupro (UK Aluminium Packaging & Recycling)

Does not support DDRS due to feasibility, contamination, and operational risks. [alupro.org.uk] - UK Trade Organisations (Aluminium Can Production & Recycling, The Can Makers, Metal Packaging Manufacturers Association)

Opposed DDRS unless proven at scale.

[metalpackager.com] - Chartered Institution of Wastes Management (CIWM)

Comments on DRS scope and resilience; notes challenges with digital implementation. [ciwm.co.uk]

Concerns over DDRS stimulate further innovation

The industry’s concerns and objections to DDRS, which continue to emerge, stimulate efforts to develop other methods that could be as successful in collecting back-up packaging as standard DRS, but in a more user-friendly and accessible form. Among these, the Smart Deposit Return Scheme (Smart DRS) represents an evolution that combines the proven incentive-based deposit model with digital tracking and flexible collection infrastructure.